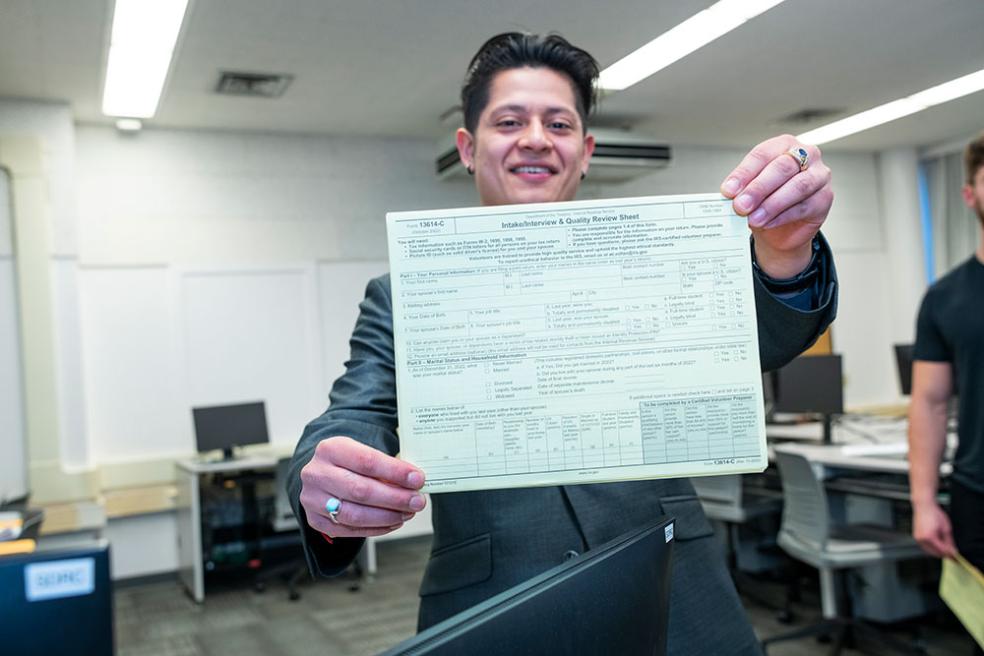

Operated by student volunteers from the School of Business, the clinic is part of the IRS’s Volunteer Income Tax Assistance (VITA) program, which helps low-to-moderate-income individuals, persons with disabilities, seniors, and limited English speakers file their taxes accurately and on time. All student volunteers are IRS-certified, having completed a series of tests to earn their qualifications.

The clinic runs every Wednesday beginning at 5:30 p.m. in Siemens Hall through the end of April. Appointments are required, and individuals can select their preferred language or request accommodations when booking online.

VITA services are available for straightforward tax returns but do not cover filings that involve significant passive income from things like investments, cryptocurrency, or pass-through business tax returns like partnerships and corporations.

“For those who qualify, all they need to do is bring their ID and tax documents—the VITA volunteers handle the rest, from preparing returns to filing them,” says Josh Zender, Business professor at Cal Poly Humboldt.

The clinics can potentially save filers hundreds of dollars. On average, individuals pay approximately $320 for professional basic income tax prep services, according to the National Society of Accountants.

The VITA clinic not only provides a critical service to under-resourced community members, but it also offers Business students invaluable real-world experience in tax preparation and client service.

VITA programs have been available nationwide for over 50 years and have been a staple at Cal Poly Humboldt for more than two decades. Additional free VITA clinics are available throughout Humboldt County, including at the Humboldt Senior Resource Center in Eureka, the McKinleyville Family Resource Center in McKinleyville, and more.

To check eligibility, schedule an appointment, or learn more, visit Cal Poly Humboldt’s VITA Clinic website.